Do you wonder how you find financial services easily when you search online? The answer is simple. We live in a digital era where visibility is the key for businesses.

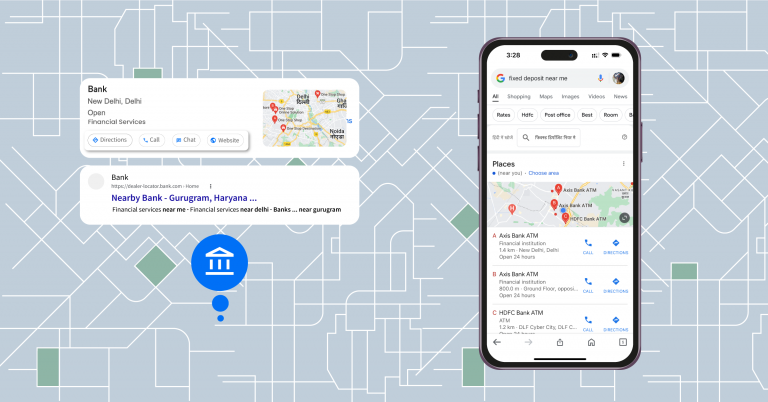

The importance of local business listings and GMB optimization in the Banking, Financial Services, and Insurance (BFSI) sector cannot be overstated. Surveys show that 64% of consumers have used Google Business Profile to learn about a local business and get contact information. These tools are not just about being found; they’re about establishing credibility and accessibility in a community where there’s a growing tendency to search for local information. The challenge for BFSI entities is balancing traditional trust and personal touch with digital strategies that amplify local presence.

This article explores how leveraging GMB and focusing on digital search powered by local intent can build a stronger connection with the community, demonstrating that in the digital age, the key to growth for financial services lies in being locally visible and digitally adept.

Financial services in the BFSI sector are increasingly focusing on building trust and dependability with their consumers, especially in the context of the challenges and uncertainties brought about by events such as the COVID-19 pandemic.

One key aspect BFSI services focus on is enhancing consumer centricity through digital channels. It aims to enhance virtual interactions and is a compelling mechanism to encourage Consumers to visit physical branches. The goal is to stress the importance of in-person engagement while seamlessly integrating digital capabilities to create a well-rounded and consumer-centric banking experience.

As digital channels increasingly influence consumer decisions, financial institutions must adopt strategic approaches to stand out in local markets. Ensuring authenticity in the physical presence of branches and ATMs through capabilities such as valid digital listings and accurate listings is crucial, as risks and security issues continue to rise. While it is all about being visible digitally, it is also about being trustworthy. This is almost non-negotiable, particularly in a segment such as BFSI.

Hence, maintaining a positive digital presence becomes imperative for these institutions to build the right perception and enhance their credibility in consumers’ eyes.

Here are some strategies that this sector may approach:

Financial services brands can significantly benefit from online review management. These reviews act as social proof, building trust among potential consumers and offering clarity about services at local branches. Encouraging satisfied clients to leave positive reviews and responding professionally to negative feedback can enhance a brand’s reputation and visibility.

For banks and financial services, local search optimization is crucial. This involves optimizing local web pages with relevant keywords such as “financial services,” “local banking,” and “trusted financial advisors” to improve search engine rankings. Additionally, creating content that addresses common financial questions can attract more visitors to the site.

Positive consumer experiences are vital in the financial sector. This can be achieved by collecting real-time consumer feedback and implementing advanced review management systems across various channels, identifying key business drivers, and monitoring end-to-end consumer journeys. Financial institutions can enhance consumer satisfaction and loyalty by understanding consumer needs and addressing them effectively. It is through such approaches that local BFSI units can improve their services and make long-lasting impacts on consumers, offering appreciable support and assurance.

Financial services must be flexible and adapt to market changes, new trends, and emerging technologies. This adaptability ensures they can meet evolving consumer expectations and maintain a competitive edge. Such flexibility allows for BFSI branches to become more prominent, stay with the times, embrace consumers, and unlock growth opportunities.

The digital era presents challenges and opportunities for the BFSI sector, particularly in enhancing local visibility and building consumer trust. The strategies discussed, from leveraging online reviews and optimizing local digital search to improving consumer experiences, are not just tactics but essential components of a successful digital transformation. In today’s competitive landscape, financial institutions that embrace these strategies can significantly improve their local presence, foster deeper consumer trust, and ensure greater accessibility to their services.

For those looking to embark on or enhance this journey, SingleInterface offers relevant products that can be of significant help. Whether it’s optimizing your online presence, managing consumer reviews, or improving local search outcomes, SingleInterface provides the tools and expertise necessary to elevate your financial services in the digital landscape.